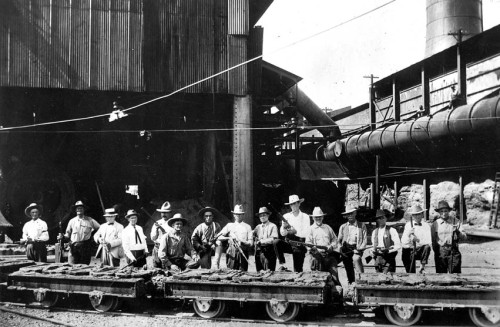

Company Guards at Old Dominion Mine, 1917

Keeping with the recovery/inflation theme of 2009, base metals, grains, and energy all appear to be have bottomed out and have started breaking out of their downward channels. Commodities are technically in deeply oversold territory and sellers have moved on. Clive Maund has posted some great commentary and charts on copper backing up my own observations that commodities are resuming an upward trend.

Clive Maund : COPPER – upside breakout imminent, implications for commodities…

Although copper may seem like a sideshow it is actually very important, for it is a barometer of changes in the world economy. In retrospect it is easy to see on its long-term chart below that its refusal to break higher for several years from what turned out to be a major top area was a warning that all was not well with the world economy. The breakdown from the lower support line of the top area led to a crash back to the first major support level where it has stabilized. It remains wildly oversold, as shown by the huge gap between the 50 and 200-day moving averages.

…more here

With silver now outperforming gold, more bang for the buck is likely to be in silver and base metals going forward – at least in the near term. If you are not in the futures market, exposure to metals can be had through ETNs like JJC and DBB or through common shares in FCX or PCU. In energy, expect Team Hope to push natural gas instead of clean coal as a clean energy.